Your Debt Isn't a Personal Failure

Politics

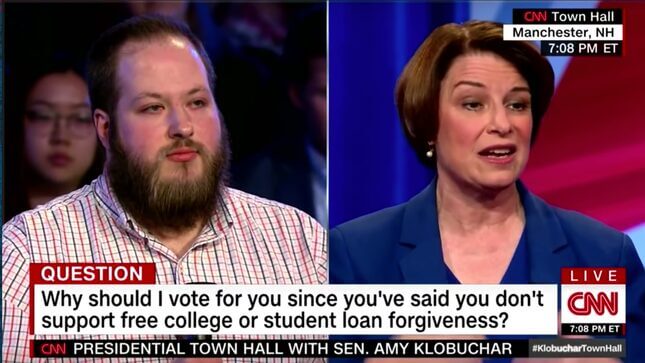

During a Monday night town hall on CNN, a college student in the audience asked Senator Amy Klobuchar why he should vote for her when she hasn’t backed student loan forgiveness like some of the other candidates in the field—notably Elizabeth Warren, who on Monday announced a proposal to erase $50,000 in student loan debt for every person with a household income below $100,000. Klobuchar’s response was, in a word, uninspiring.

“The first thing I would do is allow students, no matter how old they are, to refinance their student loans,” Klobuchar said. Her other plans: Expand Pell Grants, and free community college. “I wish I could staple a free college diploma under every one of your chairs,” she added, voice somber. “I wish I could do that, but I have to be straight with you and tell you the truth.”

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-